Dr. Lonnie Strickland

A Wealthy Life

Inspired by Dr. Strickland's work and legacy? Consider a gift to the A. J. “Lonnie” Strickland Business Student Endowed Support Fund. This fund ensures that Culverhouse College of Business will always have funds to support student experiences outside the classroom, particularly travel for case competitions and international travel opportunities.

Over his 55-year career at The University of Alabama's Culverhouse College of Business, Dr. Lonnie Strickland has inspired thousands of students. Late this April (2024), he delivered the final instance of his signature lecture, "How to Make Five Million Dollars" just in time for his retirement from the Capstone.

I just heard of Dr. Strickland’s retirement from UA.

It is both thrilling and heartbreaking news all at the same time. He is an absolute legend at the Capstone and he will be sorely missed.

His class is one I will never forget. My brother encouraged me to take GBA 490...back in 1996. He’d had [Strickland] as part of his MBA classes and I took his class while finishing my BS in business. I then encouraged my husband and several other friends and family members to take GBA 490 from Strickland...as they completed their business degrees as well.

His book is the only textbook we’ve not only kept, but consistently referred to time and time again over the years. It sits on our bookshelf in the home office. The story of switching the "hot-n-now" light at Krispy Kreme is as legendary as his “how to make a million” and I will never forget playing the game at the end of the semester. Back then we had to sell shoes. My team did not win but wow—what lessons that game taught!

He will never be forgotten.

Best,

Shea (Jeffcoat) Spiers

Class of 1997

Seeing a Need

In his lecture, Strickland explained the origin of his lifelong pursuit to teach students to be wealthy. He met a former student by chance in New York, and asked him, as was his practice, how things were going.

"Terrible," the alum replied.

Surprised, Strickland asked the former student to coffee to learn about his problems, and discovered that while the alum was successful in his career and earning a high income, he had fallen into a pattern of lavish spending and consumer debt, and was having trouble keeping his head above water. Strickland had a plane to catch, but promised to work on a solution and call the alum in a couple of days.

A few days later, as promised, Strickland called.

"I can fix you," he told the former student, "but it is going to be major surgery."

Strickland then realized that he had an opportunity to teach students how to avoid situations like this—in fact, to become wealthy—and it became his primary mission in his teaching career.

Dr. Strickland,

You...were [one of] my favorite professors in the EMBA program. Yours was a class everyone always looked forward to and enjoyed. You were always entertaining which made retaining your teaching much easier.

I know it has to be hard to retire as you seemed to enjoy teaching so much but I hope you have a great retirement.

Sincerely,

Robin Murphree

Class of 2006

Don't Buy the Car!

An informal poll to see who has the highest mileage car

An informal poll to see who has the highest mileage car

Delayed gratification is difficult for everyone, and especially new college graduates. The allure of finally being able to afford things like new cars is strong.

But since the average American car payment is currently over $700 per month, that money might be better spent elsewhere.

Strickland, in his lecture, posed a scenario: A friend buys a new car early in life. You, however, resist, and continue driving an old one. Instead of a car payment, you work to pay off consumer debt and then take the money you would be spending on a car payment and invest it instead.

Hello Dr. Strickland,

I learned of your pending retirement and wanted to offer congratulations on a long and distinguished career and pass along best wishes for your retirement.

My wife (Lisa Ganly Gray) and I were in the MBA class of 1987. In addition to getting an education, we got the added benefit of finding a spouse. In fact, I think we are one of two couples in that class who met as classmates and later got married.

We have so many great memories of our two years in the MBA program and have thought of you often in the many years since we were on campus.

One of our favorite recollections is attending what was then called the Enrichment Program where we you all tried to teach us some culture and manners. A side story… I recently met someone who had just left a job in the University of Texas MBA program where he had taught similar topics to their students. I remember thinking, “We were doing that almost 40 years ago in Tuscaloosa.”

Another of our favorites is your lecture on how to become rich.

Your impact on the business community, The University of Alabama and your students is immeasurable.

Sincerely,

Joel Gray

Class of 1987

Humble Millionaires

"I need something to tell people that I am somebody," said Strickland during his lecture, describing the near-universal tendency to buy depreciating assets like cars or designer clothing to announce status.

But where do real millionaires shop? Often at outlet malls.

How much do their houses cost? Often under $400,000.

What kind of wine do they drink? The kind that costs about $10 a bottle.

How do they travel? Often they go camping instead of on luxury cruises.

And what do they drive? Often older, reliable, non-flashy vehicles.

That's because according to Strickland, actual millionaires have learned to be content with a modest way of life in order to free up money to invest for the future. Instead of trying to keep up with peers like the young alum that Strickland met in New York, they prioritize health, family, friendships, faith, and an inexpensive way of life with low or no debt.

Dr. Strickland,

My name is Randall Drake and I took your GBA class in 1981 as I was receiving my MBA. It was my favorite class. I have had a career in banking and recently retired. I live in Brentwood, Tennessee. I recently met with a recent graduate of the MBA program who is a commercial banker in Nashville. We shared experiences and both proclaimed that you taught our favorite class. Forty three years apart but sharing the same experience. It was so gratifying.

I thank you for the instruction I received and I wish you the very best as you retire and enjoy some relaxation. I send you all the love and best wishes.

ROLL TIDE

Randall Drake

Class of 1981

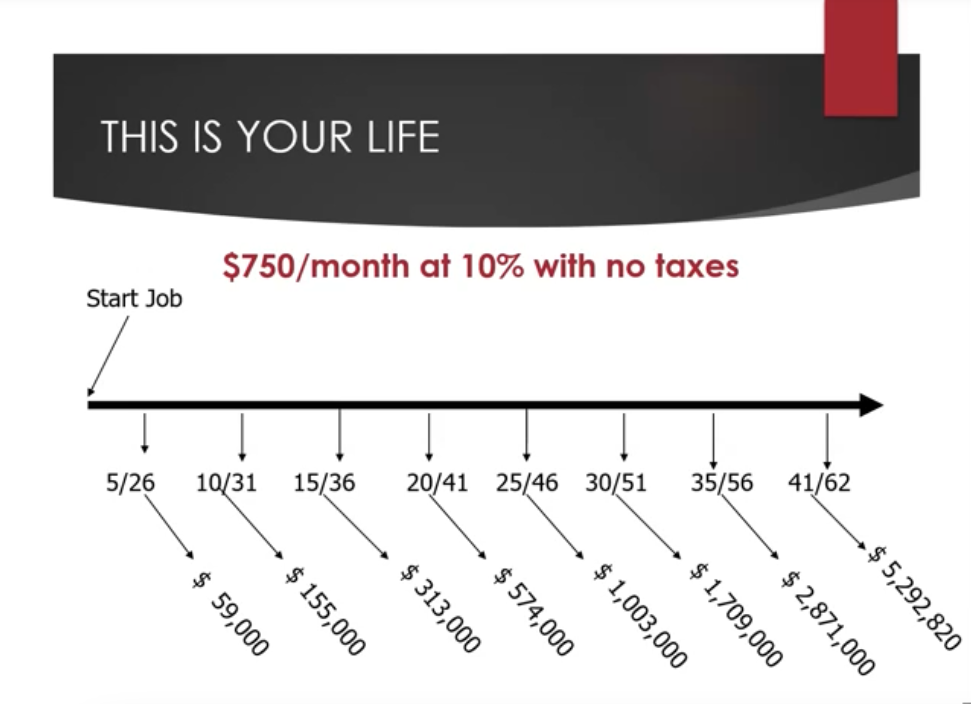

This Is Your Life

In the lecture, Strickland laid out his projections for building wealth.

Assuming a monthly investment of $750 (a bit more than the average car payment) into an investment instrument returning an average of 10% like the Vanguard VFIAX, and no taxes, starting at age 21:

- After ten years the balance will be $155,000.

- In 20 years, by the time the investor is 41, the balance will grow to $574,000.

- In 25 years, when the investor is 46, that $750 a month will become the first million: $1,003,000.

- And in 41 years, by the time the investor is 62, the balance will be $5,292,820.

Dr. Strickland,

So grateful to have had your wisdom and teachings blessed upon me, more than the course work. You have given so much to those you taught and make us so proud of you!

Wishing you the best in retirement!

Chris Olson

Class of 1985

Now...Borrow Money?

In his lecture, Strickland emphasized avoiding and minimizing debt, so it may seem odd that part of his wealth-building program involves borrowing money. But there's a good reason for it.

The downside of avoiding debt like car loans is that it can make it difficult to establish a strong credit history. So Strickland suggests a graduated program of borrowing money, starting with a $1000 in the first year of work. Pay the loan payments promptly, and then pay it off early. Repeat the process the following year for $2000, then $3000 the following year, and so on.

In this way, you establish a strong record of credit, so that when you want to start a business or need another large infusion of capital, you can get it an excellent interest rate.

I wanted to express my sincere appreciation to Dr. Lonnie Strickland for the outstanding job he has done educating thousands of students at our beloved University.

I was one of the early students to welcome Dr. Strickland when he first arrived at the University.

As an accounting major and Advanced ROTC student during the Vietnam War, I had no opportunity to take his wonderful course.

However, I was able to get to know Dr. Strickland as we both were involved in some major student organizations while at the University.

I wish him the very best and want him to know how special he has been to my family, as my three children all have their undergraduate degrees in accounting from the University, and all knew Dr. Strickland well.

Sincerely,

Judge Tim Russell

Member of the President's Cabinet

Rich vs. Wealthy

With a title like "How to Make Five Million Dollars," you might expect Strickland's lecture to be about materialism, but he distinguishes between rich and wealthy.

"I can make anybody rich," Strickland told his audience. "I just made you rich. But would you like to be wealthy?"

To be wealthy, Strickland said, is to be able to give back. This can take the form of philanthropy, using financial resources to support worthy causes and help improve the world. A solid base of financial wealth helps if this is your goal.

But giving back doesn't have to cost money. For instance, Strickland himself volunteers with a reading program for at-risk youth.

"You don't have to be rich to be wealthy," Strickland said. "But it helps along the way."

It was great to see Lonnie and hear him one final time.

Having focused my MBA electives on strategy, I recall fondly my time with him “painting the walls”, road trips to the companies we worked with, and Lonnie hosting us at his home.

Lonnie was one that inspired me to teach. Shortly after graduating, I turned down an offer from Mark Weaver to get a PhD and succeed him as professor of entrepreneurship. Instead, I pursued my passion for strategy and 30 years later I can say I am one of the people who do what they went to college to do. I still rely on the exact same industry and competitive analysis principles from Lonnie. I would not be where I am today without his investment in his students.

Best wishes to Lonnie in the years to come!

Cheers,

Craig Andrews

A Wealthy Life

Dr. Strickland says farewell (lower volume before watching)

Dr. Strickland says farewell (lower volume before watching)

Though he's modest enough not to announce his own net worth, Dr. Lonnie Strickland implied, in the conclusion of his lecture, that he has followed his own principles from a young age. This would suggest that he, himself, is a multi-millionaire.

But again, Strickland was careful not to lose sight of the bigger picture. He encouraged his audience to start building wealth where they are, even if it is later in life, and to prioritize taking care of the people around them. He urged students and alumni to keep in touch, and offered to help them in any way he can.

"Because we—all the faculty here—can never be successful until you are first successful," he concluded. "We get our success through you. So Roll Tide! We love you. Thank you very much."

Strickland walked off the stage to a standing ovation, a fitting end to career spent helping others to achieve their goals, take care of their loved ones, and ultimately, change the world.

What a wealthy man, indeed.